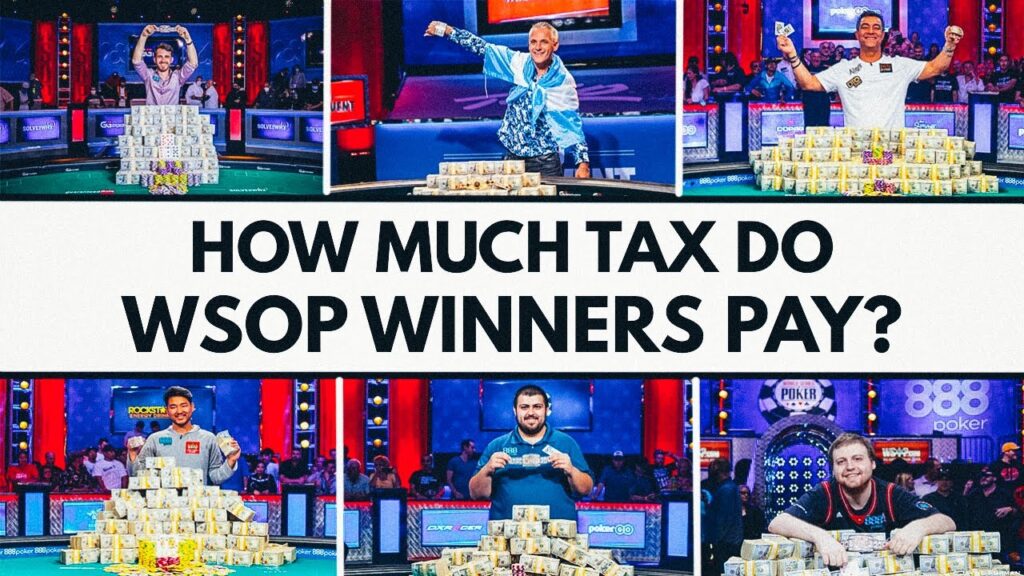

WSOP Main Event Champion Daniel Weinman will have to pay almost half of the $12,100,000 in taxes! View the 2023 WSOP Main Event Final Table Taxes here and see why the real winner is the IRS.

2023 WSOP Main Event Final Table Taxes:

| Winner | Payout Before Taxes | Payout after Taxes |

| 1. Daniel Weinman | $12,100,000 | $6,578,028 |

| 2. Steven Jones | $6,500,000 | $3,941,684 |

| 4.Jan-Peter Jachtmann | $3,000,000 | $3,000,000 |

| 3. Adam Walton | $4,000,000 | $2,442,014 |

| 5. Ruslan Prydryk | $2,400,000 | $1,944,000 |

| 6. Dean Hutchison | $1,850,000 | $1,850,000 |

| 7. Toby Lewis | $1,425,000 | $1,425,000 |

| 8. Juan Maceiras | $1,125,000 | $596,250 |

| 9. Daniel Holzner | $900,000 | $513,000 |

| Totals | $33,300,000 | $22,289,976 |

Every year, Russ Fox of Taxable Talk gives an excellent breakdown of just how much the various tax authorities will come looking for from the otherwise lucky Main Event winners.

US Poker Players Hammered by IRS

Daniel Weinman’s $12,100,000 score topped Jamie Gold’s 2006 victory by 100k, but more than $½ million will be handed over to the IRS and state taxes, the Georgia state pro expected to take home ‘only’ $6,578,028.

Daniel Weinman is the 2023 World Champion!

Daniel takes home the largest payout in Main Event history, $12,100,000, by outlasting the record-breaking field of 10,043 players.

A huge congratulations to @notontilt09, your 2023 Main Event Champion. pic.twitter.com/EsU7x6MZOa

— WSOP – World Series of Poker (@WSOP) July 17, 2023

In fact, the trio of US players who filled the podium were among the hardest hit as US tax laws are brutal towards both professional and amateurs.

Second-placed Steven Jones, even as an amateur player, has to fork out a whopping $2,500,000 of his $6,500,000 payday,, and Adam Walton in 3rd spot is in a similar spot with his $4,000,000 cash.

Fox also provides a useful table of exactly where the tax money will go, a full 33% of it!

| Amount won at Final Table | $33,300,000 |

| Tax to IRS | $8,753,797 |

| Tax to Georgia Department of Revenue | $690,777 |

| Tax to Agencia Tributeria (Spain) | $528,750 |

| Tax to State Tax Service (Ukraine) | $456,000 |

| Tax to Agenzia delle Entrate (Italy) | $387,000 |

| Tax to Arizona Department of Revenue | $193,700 |

| Total Tax | $11,010,024 |

Brits Win, Euros Lose, and Germany…?

Nobody is ever truly happy about paying taxes, but for British duo, Dean Hutchison and Toby Lewis, there is nothing to pay. British gamblers (including poker players of course) pay no tax on winnings.

With Spain, Ukraine, Italy, and Germany all represented at the final table, only the last of these – Germany’s Jan-Peter Jachtmann – might hope to avoid a hefty tax hit.

However, the businessman describes himself on Twitter as a “semi-professional pokerplayer” and that alone is probably enough for the taxman to come knocking at his door.

His $3,000,000 cash for 4th place could be cut almost in half, unless he argues that his nation’s guiding legislation – “Rennwett und Lotteriesteuer”, dating back to 1922 and exempting non-pros – covers him.

Dodging WSOP Main Event Final Table Taxes Proved Costly for Dragan Kostic

For anyone thinking that it might be easy to dodge the taxman’s demands, they should recall the fate of Spanish poker pro Dragan Kostic.

The Macedonian-born player bagged a monster €532,000 ($766,438) runner-up cash at the EPT Barcelona Main Event in 2011, but didn’t declare it on his annual tax filing.

Unfortunately for Kostic, the Spanish authorities decided to check the HendonMob.com website and spotted his huge omission.

An 18-month jail term, €400k fine and a back tax bill of more than €230,000 was the result.

- Get the best rakeback deals

- See the best poker promotions

- View the latest poker news

- Get the best No Deposit Poker Bonuses

- Benefit from the biggest poker bonus

- Watch more poker videos

- Calculate your rakeback with the rakeback calculator

- Watch the best Twitch Poker streamers

Terms and conditions apply. New customer offer and 18+ only. Please gamble responsibly! Should you require help regarding your betting pattern, visit www.begambleaware.org